The checklist is similar to the list for conventional loans unless you have gone through a streamlined refinance, which doesn’t require an appraisal. Most lenders will require a home appraisal before they approve of a refinance application as well.

Appraisal will be reviewed by the lender’s staff appraiser or VA appraiser before the reviewer issues a Notice of Value. The appraiser must be licensed by VA and will be selected by the VA. They also have a specific set of requirements before they approve a loan. VA loans are backed by the Department of Veteran Affairs and are only given to military veterans. Ventilation and mechanical systems function.Termites (just to check for evidence of termites).Lead-based paint analysis for homes built before 1978.Roof has been without leaks for at least 2 years.In addition to the points mentioned in the conventional loan checklist, USDA and FHA checklists include: Both organizations have unique appraisal checklists that house appraisers need to look at before they approve a loan. FDA loans are backed by the Federal Government to help people who can’t get loans from private lenders. USDA loans are guaranteed by the US Department of Agriculture and are designed for moderate-to-low-income applicants buying a home in a rural area. Finishing condition and quality (flooring, countertops, etc).

Va home appraisal checklist windows#

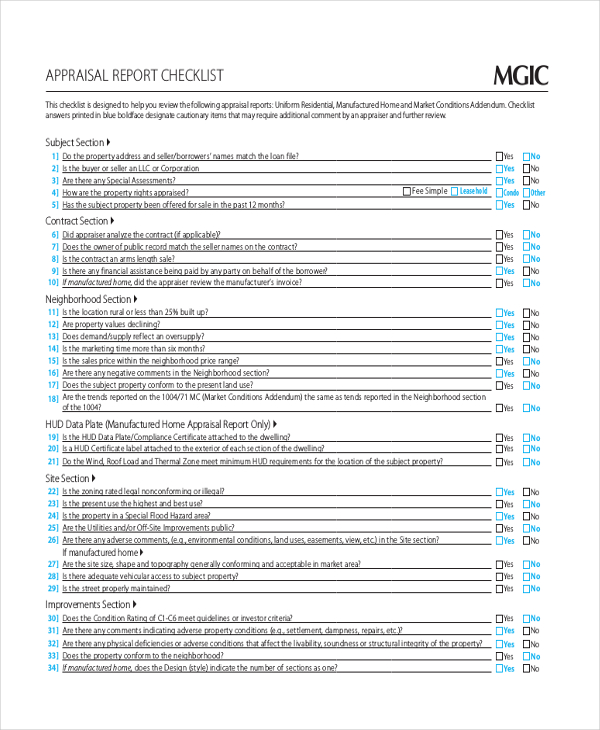

Number of rooms, bathrooms, bedrooms, closets, and windows.Private lenders have a set of requirements and will want to look at the points mentioned below during an appraisal. If you are applying for a mortgage from a private lender, you are applying for a conventional loan. Some points may overlap but different lenders have different priorities and that reflects on what they want from an assessment. The HUD home appraisal checklist will differ slightly from the bank home appraisal checklist. » Home Appraisers: We explain what an appraiser is and what they do during an appraisal. They will conduct a comprehensive walk-through of the property to see if there are any notable flaws that may impact the value of the property.Īn appraiser will also check three or more most recently sold properties in the neighborhood to get the average market value of the area. What Does Home Appraisal Consist Of?Īn appraiser’s checklist can include items like location, neighborhood, condition of the property, and market value of other homes in the area. It can take a few hours for large properties, especially if the expert has an expansive checklist for house appraisal from the lender. A streamlined refinance from FHA is an exception to this rule and doesn’t require an appraisal.Ī home appraisal can take less than an hour if the property is small. You may also need to get one if you’re refinancing your home. The lender will request a home appraisal after the seller accepts the buyer’s offer.

» Home Appraisal: Look at the home appraisal process and everything you need to know about a home appraisal. Visiting property to carry out the appraisal.Scheduling appraisal with the homeowner.The process differs from one appraiser to other, but most will follow these basic steps: If you want a comprehensive report on the property’s flaws and prospective repairs, you will need a comprehensive home inspection. Their sole purpose is to determine the value of the property. Keep in mind that appraisals are different from home inspections. These appraisals often depend on what the lender wants to know. The appraiser checklist can differ based on the loan type the buyer chooses. An unbiased third-party appraiser will consider different aspects of a home and calculate how much they will affect its value. Appraisers deduct $500 from the appraised value for each flaw they find.Ī home appraisal is the process of evaluating a property with the intention of determining its actual value.Average cost of home appraisal across the US ranges from $313 to $421.Home appraisal is requested when sellers accept the buyer’s offer on the property.Home appraisal, the valuation process of a home, is generally ordered by mortgage lenders before approving a loan.

0 kommentar(er)

0 kommentar(er)